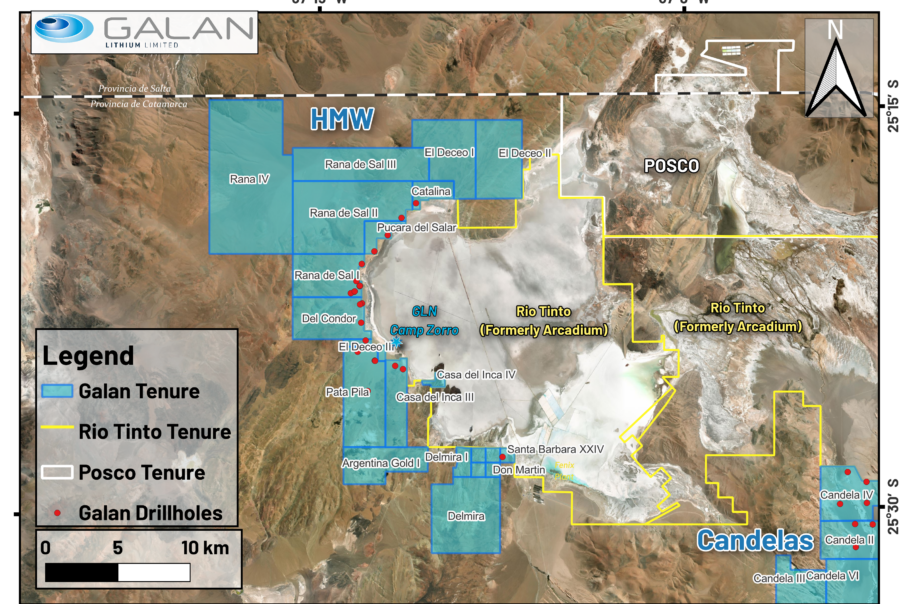

- Galan’s flagship Hombre Muerto West (HMW) Lithium Project is situated within the Hombre Muerto basin, one of the most prolific salt flats in the world.

- The basin is located in the Argentinean Puna plateau of the high Andes Mountains at an elevation of approximately 4,000 metres above sea level.

- The Project lies 90 km north of the town of Antofagasta de la Sierra, in the Province of Catamarca, Argentina, and is located to the southwest of the Salar del Hombre Muerto.

- The HMW Project is in close proximity to other world class lithium projects owned by Arcadium and Posco.

- The project is 1,400 km northwest of Buenos Aires, the capital of Argentina and 170 km west-southwest of the city of Salta.

Project Overview

- Highest grade, lowest impurity lithium brine assets in Argentina

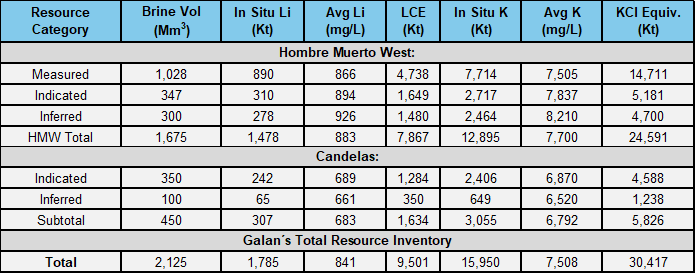

- 9.5 Mt Lithium Carbonate Equivalent (LCE) with grades of 841 mg/L (HMW & Candelas)1

- Commercial agreement with the Catamarca Government signed in April 2024 in support of the grant of permits to enable the commercialisation of lithium chloride concentrate2

- Significant regional infrastructure and investment with excellent government and community support

- Staged production plan up to 60ktpa LCE

- 20+ year history of production within salar

-

> Allows for local and international export sales

> Serves as a key requisite for obtaining Phase 2 permits

> Includes Galan's commitment to exploring further downstream processing routes

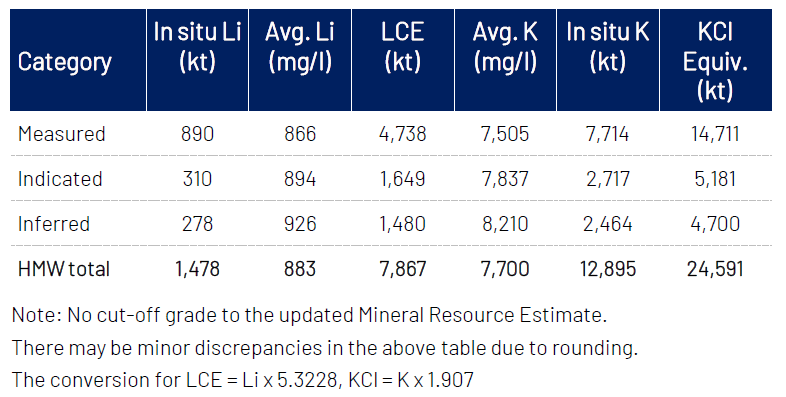

HMW (Mineral Resource Statement, March 20243 *

(Inclusive of Ore Reserves)

Definitive Feasibility Study Results – Compelling Economics

- Phase 2 DFS announced 3 October 2023

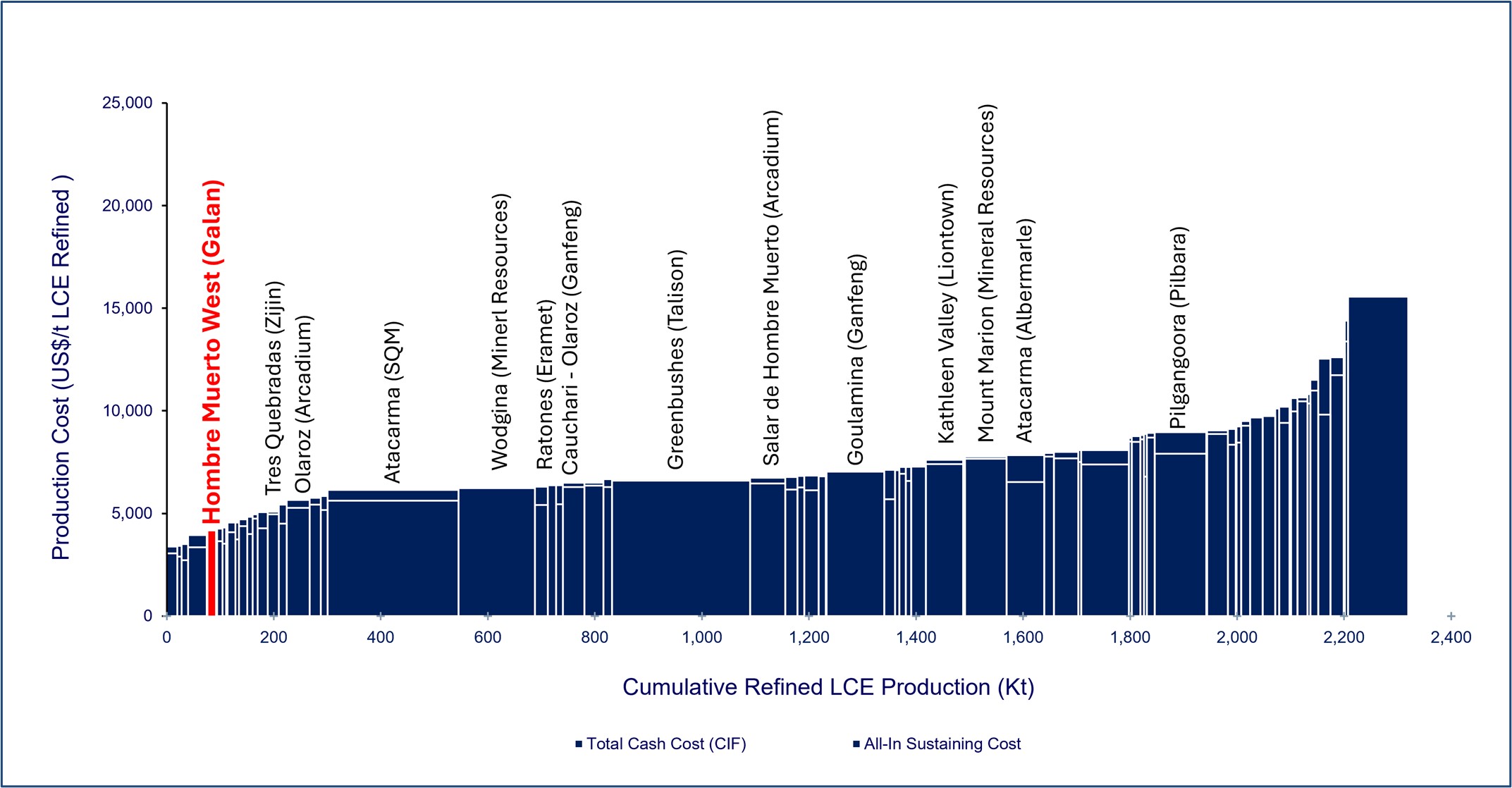

- 1st quartile on the industry cost curve

- LiCl concentrate production of 21 ktpa LCE

- Low operating cost of US$3,510/t LCE is lower than most spodumene producers, equivalent to SC6 US$310/t - US$350/t

- All In Sustaining Cost (AISC) US$7,000/t LCE, +40 yr life

- Unlevered post-tax NPV8% of US $2b

- Post-tax IRR of 43%, approx. <3 year payback

- Post-tax Free annual cashflow US$236m

Wood Mackenzie 2028 Lithium Cost Curve: AISC (US$/t LCE)

* Wood Mackenzie Disclaimer

“The foregoing information was obtained from the Lithium Cost Service™ a product of Wood Mackenzie.” “The data and information provided by Wood Mackenzie should not be interpreted as advice and you should not rely on it for any purpose. You may not copy or use this data and information except as expressly permitted by Wood Mackenzie in writing. To the fullest extent permitted by law, Wood Mackenzie accepts no responsibility for your use of this data and information except as specified in a written agreement you have entered into with Wood Mackenzie for the provision of such of such data and information.” Information sourced in December 2024.

Notes:

1. A cut-off grade of 500 mg/L updated Mineral Resource Estimate for Candelas.

2. The Mineral Resource Estimate for Hombre Muerto West in unchanged from 27 March 2024. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcements, and that all material assumptions and technical parameters have not changed.

3. There may be minor discrepancies in the above table due to rounding.

4. The conversion for LCE = Li x 5.3228, KCl = K x 1.907.

5. Candelas tenements are located about 40 km to the Southeast of the HMW Project. The Candelas Mineral Resource Statement was originally announced by Galan on 1 October 2019.